ROCKLAND RESOURCES ACQUIRES THE ELEKTRA CLAYSTONE LITHIUM PROJECT IN SONORA, MEXICO

Vancouver, British Columbia, November 16, 2021: Rockland Resources Ltd. (the "Company" or "Rockland") (CSE: RKL) is pleased to announce it has signed an option agreement to earn a 100% interest in the very strategically located Elektra (“Elektra Project”) claystone lithium project located in northern Sonora, Mexico, contiguous to the advanced Sonora Lithium Project (“Sonora”) owned, and being developed, by Bacanora Lithium Plc (“Bacanora”) (50%) and Ganfeng Lithium Co., Ltd. (“Ganfeng”) (50%).

The Sonora project hosts (source Bacanora Annual Report December 31, 2020) “a large, scalable and high-grade lithium resource (*) with construction in progress directed at the first lithium production in 2023.”

Rockland’s CEO, Mike England stated "The Elektra Lithium Project acquisition represents a decisive move into the battery metal sector for Rockland, in addition to our gold exploration projects. With global lithium demand expected to quadruple by 2025, and with claystone lithium deposits recognized as a significant near-term lithium production source, the acquisition of the Elektra Project is a rare opportunity. Our knowledge of the project through an associated company, and our experience and familiarity with both the owners and the technical team that worked on the Elektra Project, will allow us to fast-track exploration activities.”

Dr. Richard Sutcliffe, reports “The Elektra Lithium Project targets lithium-rich clays and claystone units, derived from alteration of shallow-dipping volcanic rocks. Rockland’s exploration program will have the objective of defining a lithium resource on the Agua Fria prospect and to test multiple other lithium targets outlined by surface sampling and trenching, that could potentially be developed by low-cost, low-strip, conventional open pit mining.”

Highlights of the Elektra Project:

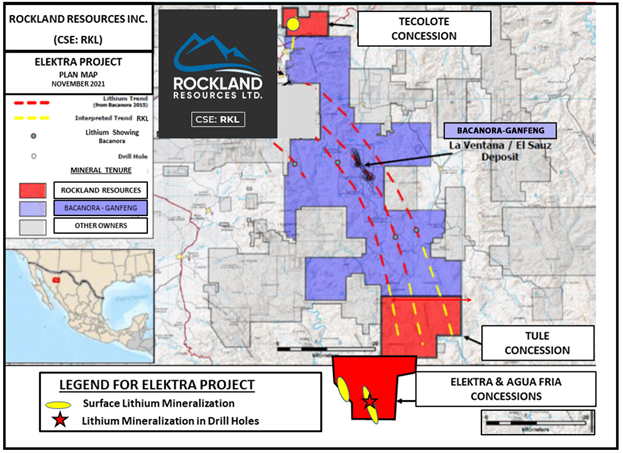

- Large property – the Elektra project comprises four exploration concessions totalling 41,818 hectares (418 square kilometers) in the northern portion of the Sonora, Mexico.

- Drilling - Only a limited portion of the Agua Fria target has been drill tested to date. On the Agua Fria target, a total of 16 RC drill holes were completed between April and June 2017, comprising 1,762 meters. Drill results from this maiden drill program were encouraging with several intervals of greater than 900 ppm Li over widths of up to 90 meters. The best drill intercepts include hole AF 17-001 returning 1058 ppm Li over 33 meters from a depth of 3 meters; plus 21 meters averaging 1043 ppm Li from a depth of 54 meters, and in hole AF 17-014, from 0 to 24 meters, 1050 ppm Li over 24 meters. The Elektra Property has additional lithium anomaly targets on Tecolote that have not been drilled.

- Knowledge and Data – the Elektra Project was initially proposed in 2015 and the current Mexican owners, and members of the technical team, remain involved. Work conducted from 2015 to 2018 is readily available to the company and was completed to 43-101 standards and represents an opportunity to fast-track exploration activities on various targets on the Elektra Project.

- Strategic Position – the Elektra Project concessions are contiguous to the north (Tecolote) and south (Tule) of Bacanora-Ganfeng’s Sonora Property, on trend with the mineralized lithium-bearing clay units localised within volcaniclastic sediment successions in the basins. The Agua Fria target is located southwest of the Sonora Property and was the site of the discovery of significant lithium-bearing clay units in surface exposures and in reverse circulation (RC) drilling in 2016-2017.

- The Agua Fria prospect, located within the Elektra concession, was interpreted as having similarities to the La Ventana Zone on the Sonora Property and is characterized by fine-grained minerals, a portion which contain lithium, providing significant potential to increase plant feed grades by beneficiation.

* Lithium values and mineralization described on adjacent properties in similar rocks are not representative of the mineralization on the Elektra Project, and historical work and activities on the Elektra Project have not been verified and should not be relied upon.

Rockland further announces it has arranged a non-brokered private placement of 12 million units ("Units") at a price of $0.20 per Unit for aggregate gross proceeds of $2,400,000.00 (the "Offering"). Each Unit will be comprised of one common share ("Share") and one half of one transferable Share purchase warrant of the Company ("Warrant"). Each whole Warrant will entitle the Subscriber to purchase one Warrant Share for a 24-month period after the Closing Date at an exercise price of $0.30 per share. Proceeds raised from the Offering will be used towards exploration activities on the Company’s newly acquired Elektra Lithium project as well as general and administrative purposes.

The Company can earn a 100% interest (less NSR) in the Elektra Lithium project through cumulative option payments of 10 million common shares in the Company and US$1.5 million over a 48 month period. A 2% NSR will be granted to the vendors and the Company will have an option to purchase 50% of the NSR for $1,000,000 at any time. A finders fee will be payable.

Garry Clark, P.Geo, a qualified person under National Instrument 43-101, has reviewed and approved the technical content of this news release as it pertains to the Elektra Lithium Property.

About Rockland Resources Ltd.

Rockland Resources is engaged in the business of mineral exploration and the acquisition of mineral property assets for the benefit of its shareholders.

On Behalf of the Board of Directors

Richard Sutcliffe

President and Director

For further information, please contact:

Mike England

Email: mike@engcom.ca

Neither the Canadian Stock Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

FORWARD LOOKING STATEMENTS: This news release contains forward-looking statements, which relate to future events or future performance and reflect management’s current expectations and assumptions. Such forward-looking statements reflect management’s current beliefs and are based on assumptions made by and information currently available to the Company. Investors are cautioned that these forward looking statements are neither promises nor guarantees, and are subject to risks and uncertainties that may cause future results to differ materially from those expected. These forward -looking statements are made as of the date hereof and, except as required under applicable securities legislation, the Company does not assume any obligation to update or revise them to reflect new events or circumstances. All of the forward-looking statements made in this press release are qualified by these cautionary statements and by those made in our filings with SEDAR in Canada (available at WWW.SEDAR.COM).

Back To Archive